This is a long post, but I promise it contains some very important information that you probably didn’t know…

Let me begin with a little history. When we first purchased our boat back in 2013, we didn’t have a clue about what kind of insurance we needed, just that we needed it. We were not sailors. Peter and I both had over 10 years of boating experience, but not on the kind that had masts and keels jetting conspicuously straight up and straight down from the hull. Countless mishaps and horror stories were shared with us by each person we encountered, engraining the fear into us that we needed insurance, whatever the cost.

“You haven’t really sailed in Florida waters unless you’ve run aground at least once!” they would say…

You may be wondering, “do you really need insurance?” It’s a very personal choice. If you’re like us and just sold everything you own to sail away on a boat, then you’re probably leaning towards Hell Yes! My go-to source of information over at CommuterCruiser.com has some excellent information about deciding on if you need insurance, and what types of insurance to consider. Everyone’s circumstances are different and the value of your boat may not be worth the annual premiums in the end. On the other hand, if you live on your boat in the Hurricane Belt, especially during hurricane season, it’s a pretty important investment. For those that do opt to get insurance, there are quite a few wrinkles to iron out first.

If you’ve ever tried to get insurance on a boat or a car for the first time, you know that pretty much no company wants to cover you. If you find a company that will actually give you a quote, they tack on an astronomical premium and require a bunch of other ‘stuff” to make it even more difficult for you to bind coverage. Since our boat is 35 years old, it made it even harder to find a company that would insure an ‘older’ boat. Some of the highly recommended companies wouldn’t offer us quotes at all simply due to the age of the boat.

I’m normally the one that takes care of all the paperwork but Peter wanted to take care of the research for our first insurance policy on the boat. Being as charismatic and handsome as he is, I don’t think he’s ever received this kind of rejection before! Albeit deflated, he found a policy with IMIS insured by Concept Special Risks that quoted us at about $3,000 for an annual premium. It was really our only option at the time. We had to have a licensed Captain be listed as an operator on our policy and that Captain had to sign a statement saying that Peter was capable of single-handing the boat.

Luckily, we knew just the guy to help us out. We hired Tom Crow (out of Burnt Store Marina on the West Coast of Florida) to come out sailing with us and we showed him we could safely operate the boat. Thanks Tom!! Granted, we were in the protected waters of Charlotte Harbor, but this was a piece of cake, we thought. Tom recommended we hang back for about a year (really?!) to gain some experience on inland waters, but we had other plans…

After coughing up $3k for a policy we really didn’t understand, we set off on the beginning of our journey. In order to be covered, we thought we had to be below 12 degrees 40′ north latitude during hurricane season so we booked it through the Bahamas, DR, Virgin Islands and all the way down the Eastern Caribbean, barely scraping the surface of all the amazing places we wanted to visit. We arrived in Grenada for our first hurricane season sometime in June last year. August rolled around and we didn’t get new quotes in time to try to reduce our premium, but instead automatically renewed for something like $2,800. Again, we forked out the cash without fully understanding our policy. I tried reading the contract, but it just really didn’t make sense. Who really understands these contracts anyway?

This year, I decided to do my homework early and find some better quotes. I put feelers out in the many sailing groups on Facebook and started getting a few new agency names to contact. I also started researching some of the technical mumbo-jumbo that was in my first two policies in an attempt to actually understand what we are paying for.

While scouring the forums and Facebook comments about the topic at hand, I quickly learned I should be cautious of companies offering the lowest premium. As the old saying goes, “If it sounds too good to be true…” I even felt a little embarrassed to learn that there are some companies that are known for doing everything they can to NOT pay out on a claim. On the other hand, there are some companies with excellent reputations for swift claim handling and fair payouts. Needless to say, that amazingly low quote I found turned out to be from a company that was notorious for not paying on claims.

This wasn’t all I learned…

WHAT MARINE INSURANCE COMPANIES DON’T WANT YOU TO KNOW

In my research I happened to notice one gentleman who’s comment really stuck out to me. He said, “Be sure to ask if your policy has Consequential Damage. Consequent-what?! He mentioned busted through-hulls and sinking so I figured it was pretty important. Google led me to an article from BoatUS called Five Questions To Ask Your Boat’s Insurance Agent. It was written in 2011 but contains some very interesting things to consider.

After reading this article and getting down to business with some of the insurance agents I had received quotes from, here is what I learned about what Marine Insurance Companies Don’t Want You To Know :

Consequential Damage:

Catastrophic losses that include fire, explosion, sinking, demasting, collision or stranding are considered a “consequence.” For example, when your boat sinks due to a rusted, through-hull fitting breaking off, the sinking is a consequence of the broken thru-hull. This is a serious concern for older boats (like ours) where nearly every single part on the boat, down to every last hose clamp, has probably been replaced already or needs to be replaced soon.

“According to marine survey firms, leaks at through-hulls are estimated to be the cause in 18 percent of sinkings while under way. The numbers are worse at the dock, where failures of fittings below the waterline account for a full 50 percent of sinkings.”

If a loss is caused by a clear-cut lack of maintenance, the company can deny a claim. This is specifically referring to a total disregard of any type of maintenance such as leaving a boat unattended for months on end with bilge pumps not working due to dead batteries, or electrical wiring that is a clear fire hazard, or a boat anyone could look at and say “this is an accident waiting to happen”. The best thing to do is be extremely diligent and responsible with your regular maintenance and keep organized records. A reputable company that covers Consequential Damage will not try and deny a valid claim as they can be sued for bad faith.

The policy wording may not specifically say consequential damage is covered, but the exclusions would therein not list fire, explosion, sinking, demasting, collision or stranding, grounding, lightening strike or hurricane damage in an “All Risk” policy. If a policy does not cover Consequential Damage, it would specifically exclude this type of loss. If ever you are unsure, ask your insurance agent!! It’s their job to explain this type of stuff much better than I ever can. I can almost guarantee they won’t tell you about this item though, unless you ask. Our last two policies with IMIS/Concept did NOT include Consequential Damage and we didn’t have the foggiest idea it even existed.

Ask For Discounts:

Some insurance companies offer discounts for endorsements such as Boater’s Safety Courses, Captain’s licenses, and other US Coastguard approved courses completed. Most will offer incentives for applicants with 10+ years of boating experience and zero losses. If you don’t ask about discounts, no one is going to offer them to you.

It’s also usually cheaper to pay your premium from your checking account instead of paying by credit card. Someone is stuck with the credit card fee in every transaction, whether its you or the business you are paying. If you prefer to pay by credit card, find out if you will be charged an additional fee.

Variations in Coverage Values:

During the process of obtaining quotes from various companies, I noticed that some of them quoted me twice. Once for just a little above the value of our boat, and once for just a little lower. The premium difference was substantial with all other coverages the same. Why? I don’t know. But it’s worth asking your agent to play around with the insured value of your boat.

If you don’t receive the exact coverages you want, ask for them to be re-quoted. Some agencies quoted me with their standard $5,000 medical coverage but it didn’t cost that much more to increase it to $10,000. Some quotes included towing for no cost, some didn’t include it unless you asked about it. Same goes for Uninsured Boaters. If this is a coverage you want in your policy, make sure it specifically says it in the quote.

The agent you are working with should help you build a policy that suits your individual needs and wants. If you’re not happy with a particular coverage, talk to your agent. If you received a better quote from a different company, ask if they can match the quote. It doesn’t hurt to ask!!!

Pay attention to your deductibles also. Usually, named storms require your deductible to be doubled. This is typical, but if your hull deductible is already high, damage to your boat during a named storm might cost you more than you think. In our case, the highest chance of damage occurring to our boat is during a named storm, so this deductible is particularly important.

Just remember, if it’s not listed on your quote, it won’t end up on your Certificate of Insurance, and it won’t be covered. Cross those t’s and dot those i’s!!

Actual Cash Value vs. Agreed Value (copied verbatim from here):

When comparing physical damage coverage, the most significant difference that can be found among boat or yacht insurance policies is whether the coverage is based upon “agreed value” or “actual cash value” (ACV) loss settlement. Agreed value policies normally pay the amount shown on the policy if the boat is considered to be a total loss. Under such a policy, damage resulting from a partial loss is generally paid for on a replacement cost (new for old) basis, less your deductible; that is, physical depreciation will not be factored into determining the value of the lost or damaged items. However, some items that are subject to higher amounts of normal wear and tear, such as canvas, sails, trailers and some machinery, may be subject to allowance for depreciation in the event of a covered loss.

An actual cash value policy provides less coverage than an agreed policy, but generally at a lower cost. An ACV policy provides coverage up to the current market value of the vessel in the event of a total loss, taking into account depreciation and the condition of the boat at the time of the loss. Payments made for partial losses are usually reduced based upon physical depreciation of the lost or damaged items, and the policy deductible is also applied.

Claim Handling:

As I mentioned above, I was a little embarrassed to learn that there are some companies that are known for doing everything they can to not pay out on a claim. On the other hand, there are some companies with excellent reputations for swift claim handling and fair payouts. Needless to say, that amazingly low quote I found turned out to be from a company that was notorious for not paying on claims.

An insurance company’s reputation for claim handling can really only be measured by talking to other policy holders with claim filing experience. Of course every situation is unique, but generally speaking, some companies are just plain better to work with than others.

Individual insurance companies are backed by larger umbrella-type insurance companies such as Lloyds of London. It’s important to find out who your policy is insured by, and who they are backed by in the event that they cannot pay out on your claim. Smaller companies may have cheaper annual premiums, but they may not have the financial ability to actually pay out on a large claim.

Inside The Box:

For the most part, we had no issues with IMIS (other than the somewhat-expensive premiums and high deductibles). Al Golden and his team have literally the best reputation I could find in my research, and they have an excellent reputation for claim handling and fast payouts; another reason we went with them in the first place. What frustrated me was that for the two years we were covered through IMIS, we didn’t know that they actually covered us ‘Inside The Box’. I’m still not clear if our premium would have gone up, or if our deductible would have been higher, but the fact is, I didn’t even know it was an option.

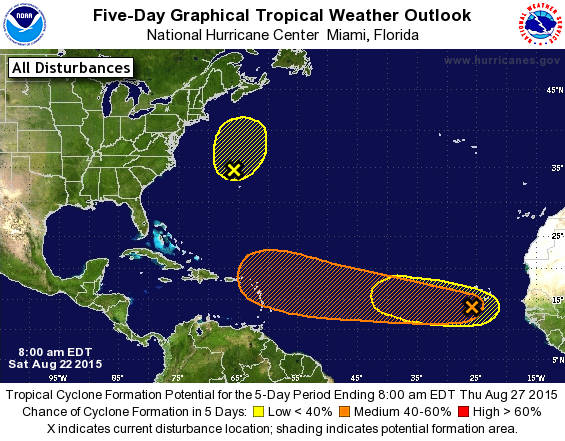

What is ‘The Box’? Most insurance companies won’t insure you if your boat will be within the Caribbean geographical box of 23.5 degrees North (Tropic of Cancer, Florida Keys) down to 12.4 degrees North latitude (Grenadines) and from 55 to 87 degrees West in effect between June 1 and November 1.

I chalk this one up to the fact that I never took the time to ask the question the right way to get a clear answer. I’m not blaming IMIS for not giving me a clear understanding of my options for coverage with corresponding price differences, but I am kicking myself for not taking the time to ask in the first place. We assumed we were not covered inside the box and therefore declared on our application that we would be south of 12.4 degrees North during the specified Hurricane Season. It’s not a bad thing, but we did a lot of rushing our schedule to get outside the box to make sure we’d be covered by our insurance.

Come to find out, there are more companies than I thought that will cover you inside the box for no additional cost. It’s very important to specify on your policy whether you might be in this box or not, even if you’re not sure, and find out what the price difference is, if any. Insurance companies can deny your claim if you don’t have the true navigational limits of your vessel declared on your policy before an incident takes place.

Liveaboard Coverage:

Again, it really pays to ask the right questions. Some companies charge extra for liveaboards, some don’t charge anything, and some simply don’t allow it. If you don’t specify this on your policy or falsely declare your true status, the company may deny any claims that arise on your behalf later on.

When we first bought our boat we were told by many people that “whatever you do, do NOT say you are liveaboards!!” Well that was terrible advice! We didn’t fully understand the nature of the issue and obviously neither did they. It makes way more sense to be honest about your liveaboard status and make sure it’s covered by your insurance. Anyone who reads this blog can find out in about 2.5 seconds that we live aboard full time. Why would we ever try to hide this from our insurance company, especially if they may deny a claim from us should we ever need to file one?!

In the end, it comes down to doing your own homework and not just listening to the guy on the boat next to you. He may not know what he’s doing either ;)

THE BIG DECISION

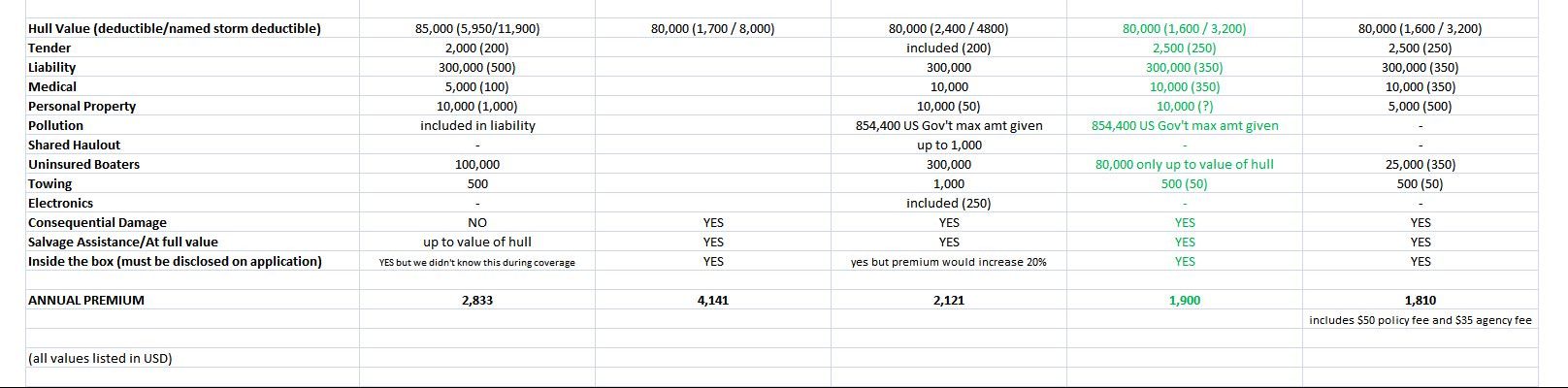

After factoring in all this new information, I had to really see it all on paper in front of me. I drew out a quick chart by hand and began listing all the differences in coverage provided by the various quotes I received and narrowed them down to my top 5 choices.

Since I was now getting intimately familiar with all this insurance mumbo-jumbo, I decided to delve a little deeper with IMIS and ask about their renowned Jackline policy from Markel American. Two years ago I thought all IMIS policies were the Jackline policy, but that is far from the truth. Our agent, Heather, provided some very helpful information in understanding the difference between our Concept policy and the Jackline policy they also offered. Some of the most striking things I learned were the following:

- Though neither policy covers losses while the vessel is being used illegally, in the Jackline policy there is no absolute requirement that the vessel be in compliance with all applicable laws and regulations whereas under the Concept policy coverage is void if you fail to comply with any applicable law or regulation.

- With Jackline, additional living expenses incurred due to temporary loss of use of the vessel as a residence is covered.

- Coverage of diving equipment is not restricted with Jackline as it is under the Concept policy.

- Covered personal property includes money, jewelry, watches, furs, china, glass silverware, antiques, collectibles, computer software or valuable papers unlike the Concept policy which excludes such items from coverage.

The Jackline coverages were nice, but the price tag associated with our specific circumstances was not.

Renewing our policy with IMIS through Concept would have been easy but our deductible was substantially increased and Consequential Damage was not covered. A new, very important item to us.

Craig at Novamar (quoted through Seaworthy) provided a much lower quote than IMIS and did include Consequential Damage. Craig was very pleasant to work with and very helpful in providing answers to all of my new and tedious questions about marine insurance coverage. We were about to sign on with him until we found a different quote from Pegasus that offered coverage inside the box at no additional cost, whereas Novamar would have increased our premium by 20% for these navigational limits. If we didn’t plan to be inside the box during hurricane season next year we would have strongly considered Novamar.

I discussed all of our options with Peter and we both agreed that The Pegasus Group offered by far the best value. The policy was backed by Lloyds of London directly, cutting out the middleman insurance company, and has an excellent reputation and rating. The deductibles were much lower than our existing policy and all the other limits were comparable. In fact, the named storm deductible from Pegasus is lower than our regular deductible from IMIS! Lloyds offers deductibles as low as any company will go, standard hull deductible of 2% and a hurricane deductible of 4%. Most importantly, Consequential Damage was covered, there was no additional charge for being liveaboards, and there was no additional premium hike for staying ‘inside the box’ during Hurricane Season!! As an added bonus, Pegasus accepts surveys done anywhere from 3-5 years ago, instead of the typical 2-year maximum for new customers applying to other marine insurance agencies/companies. This was a huge factor for us because our last survey was dated July 2013 and we didn’t plan to haul out again until 2016.

We were referred to Pegasus by our friends Skeeter and Amy. They live aboard Saltwhistle, another Whitby 42 that we’ve been traveling with during the last few months.

Please note: The company we chose at the time specialized in the Caribbean so they may or may not be able to help with other regions as competitively as they can in this region. Be sure to do your own research to find the best policy type and price for your own individual circumstances.

New coverage was bound just in time for our last policy to lapse. We agreed on coverage with a day to spare and sent in payment soon after.

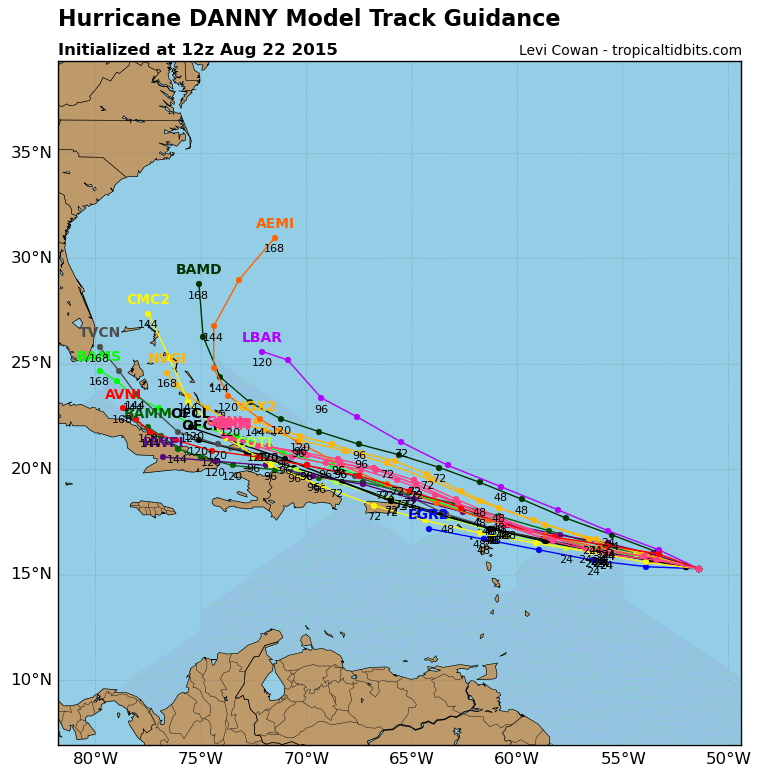

Our story, however, doesn’t compare to our perfectly-timed referral, subsequent switch to Pegasus and thousands of dollars saved by our friends Brittany and Scott from Windtraveler. I had been chatting over facebook with Brittany one evening as Hurricane Danny was forecasted to be a direct hit on their boat, Asante. She briefly mentioned she was just dropped by her insurance company as they suddenly decided to discontinue coverage for liveaboards! With a hurricane on the horizon and no insurance on their boat, I immediately urged her to contact our new agent to see if he could help. She tells the incredible story best so click over and read it in her words to get the full effect :)

A little bit of advice directly from our agent:

ALL companies will deny claims if you give them a reason to. This is why it is important to go with an agency that specializes in marine insurance to make sure the coverage is set up right. The most frequent reason I see claims denied are for the following reasons:

- People obtain a named operator policy and they let someone else operate the boat who is not approved.

- They go outside their approved navigational limits/area. We get three or four calls a year from people who tell us “Well I’m back in Maryland after a safe trip from Tortola.” We then remind them that their policy only covered them while in the Caribbean.

- We get many, many tender thefts. Tenders are covered for theft, however they have to be locked when not in use and they cannot be towed. They can be towed but they are not covered when towing.

- We have a lot of people set up their policy for Pleasure and end up doing charters without changing to a commercial policy.

Please know that we are in no way sponsored by Pegasus, nor do we receive commission for referrals to The Pegasus Group. I’ve sifted through a lot of info while writing this post and the selection we made was based solely on our personal needs and circumstances. In my research I came across a lot of articles written by insurance companies that appeared to have a significant amount of bias and ulterior motives for making themselves sound good. Do your homework and consider the source.

If you’re shopping for boat insurance, I sincerely hope my research will help you make an educated decision before forking out that cash to pay your premium. I cannot stress enough that you should take the time to research the various insurance companies and insurance terminology to make sure you understand what you are paying for. If you don’t ask the questions, no one is going to tell you the truth!!

Check the forums, reach out on Facebook, and ask other boaters about their experiences. Ask detailed and thorough questions to your prospective insurance agents and don’t let them get away with vague answers. AllThingsBoat published an article about comparing boat insurance that you might find helpful while learning the terminology. The companies reviewed are not the only companies out there, but it’s a good starting point. The Pegasus Group also has a helpful explanation of most insurance jargon posted on their website.

Definitely do all you can to prevent disasters from happening, but also make sure you are protected – just in case!

If you have any helpful insight that I may have left out or if you simply want to share your experience, please leave a comment below!

**UPDATE: This post has been shared across social media outlets more times than I can count in the last few years and I’ve seen some very interesting and helpful discussions and comments in response to this article in many places. If you have the time, search for this article in past Facebook Group posts etc. to educate yourself even further.